Sponsorship Opportunities Are Now Available

A Senior-level Benchmarking Forum of Pre-Qualified Buy Side Heads of Trading and Hand-Picked Providers

At TradeTech Connect, you’re in control. Your schedule is customised so you can cut through the noise and get your strategic benchmarking and vendor evaluation needs covered within days, not weeks.

As attendance is restricted to senior-level budget holders from top buy side firms and a select group of best-of-breed vendors you will:

- Brainstorm practical ideas to transform your trading desk through private, closed-door buy side only think tanks led by market leaders

- Efficiently evaluate the leading liquidity and execution offerings during conveniently arranged 1-1 meetings with vendors that you select based on your current desk priorities.

It’s a Platinum Members’ Club offering a bespoke experience for those shaping the future of equity trading. It’s where you make the connections you need to make, when you want to make them.

‘A really well-structured event with well-considered opportunities to exchange ideas and views with my Head of Desk peers.’

Dermot DunphyDeputy Head of Equities Dealing

M&G

‘The closed-door format of the event meant we could have open and honest conversations with our peers that we can't get at other conferences.’

Joseph ColleryHead of Trading

COMGEST

‘A fantastic new event offering with a differentiated format on a smaller scale for industry leaders. The ability to have more detailed and specialised conversations, and opportunities to learn in a more personalised environment were hugely valuable.’

Simon StewardHead of European Equity Trading

Capital Group

Shape the industry. Drive Transformation with:

Our 2024 Speakers

Tom Stevenson

Head of Trading

Fidelity International

Adam Conn

Head of Trading

Baille Gifford

Peter Hughes

Senior Equity Trader

Northern Trust Asset Management

Ali Hollingshead

Chief Operating Officer, Investment Management

Jupiter Asset Management

Ashwin Venkatraman

Global Head of Equity Trading Technology

J.P. Morgan Asset Management

Benjamin Bouillou

Co-Head of EMEA Trading

Man Group

Renate Patel

Head of European Equity Trading

Manulife Investment Management

Alexandre Kubiak

Head of Trading & Analytics

Nordea Life & Pension

Matthew McLoughlin

Chief Commercial Officer

Liontrust Asset Management

Stuart Lawrence

Head of UK Equity Trading

UBS Asset Management

Benchmark Your Strategies For:

- Adapting your hiring and training approaches to attract top talent and train for new skillsets that future proof your dealing desk

- Evolving your desk-set up to best navigate the new regulatory and liquidity landscape

- Building a flexible approach to trade automation to improve execution outcomes across your high and low order flow

- Integrating the latest ESG principals on your dealing desk to meet new investor demands

- Leveraging the latest TCA innovations to improve execution performance and minimise market impact

The Connect Difference

Transformative Content

We only cover strategic content and hand-pick senior-level speakers and attendees. And because we pre-qualify based on decision-making responsibility and budget, you get invaluable peer-to-peer information and take-aways.

Personalised Connections

Because you tell us your priorities, we create closed-door tailored interactive sessions and connect you with the right solutions partners in 1-1 meetings, saving you time on competitor benchmarking and vendor evaluation.

A Luxury Experience

We only select luxury venues in a captive location, a perfect environment for quality learning and networking with no distractions.

Highest Priority Content. Created for Decision-Makers.

Integrating alternative liquidity pools into your existing workflow to drive trading performance

Harnessing holistic TCA processes across pre and post trade, risk management and compliance to enhance execution

Evaluating trade automation initiatives to improve your execution performance across high and low touch order flows

Assessing how the equities consolidated tape will impact investor interest in European markets and the implications on your trading desk

Benchmarking proven approaches to sourcing and retaining top talent to build a high performing execution desk

Delving into major geopolitical risks threatening macroeconomic stability and how they will impact financial markets

How It Works

A Bespoke, Senior-Level Experience

If you qualify to attend, we’ll ask you about your strategic priorities and we’ll build your personalised agenda and meeting schedule.

Connect with Hand-picked Solutions Providers 1-1

Based on your profile we’ll match you with leading solution providers, assisting with the vendor selection process. You are in full control as you will only meet with the providers you are interested in evaluating.

Speak Freely in Interactive Formats

Sessions are not recorded or covered by press. The ‘closed-door’, interactive discussions encourage openness, so you get more detailed information and takeaways than at any other event.

What our VIPs say about Connect

TradeTech Connect is a fantastic new event that offers a differentiated format on a smaller scale for industry leaders. The ability to have more specialised conversations and opportunities to learn in a more personalised environment was hugely valuable

’’Simon Steward

Director & European Head of Equity Trading

Capital Group

A really well-structured event with well-considered opportunities to exchange ideas and views with my Head of Desk peers

’’Dermot Dunphy

Deputy Head of Equities Dealing

M&G

Fantastic opportunity to meet and network with peers and listen to really good panel debates and interviews. Already looking forward to the next event.

’’Matthias Erikson

Head of Global Equity Execution

AP2

Who Joins TradeTech Connect?

Only Senior-level, Pre-Qualified Buy Side Heads of Trading from Europe and beyond attend:

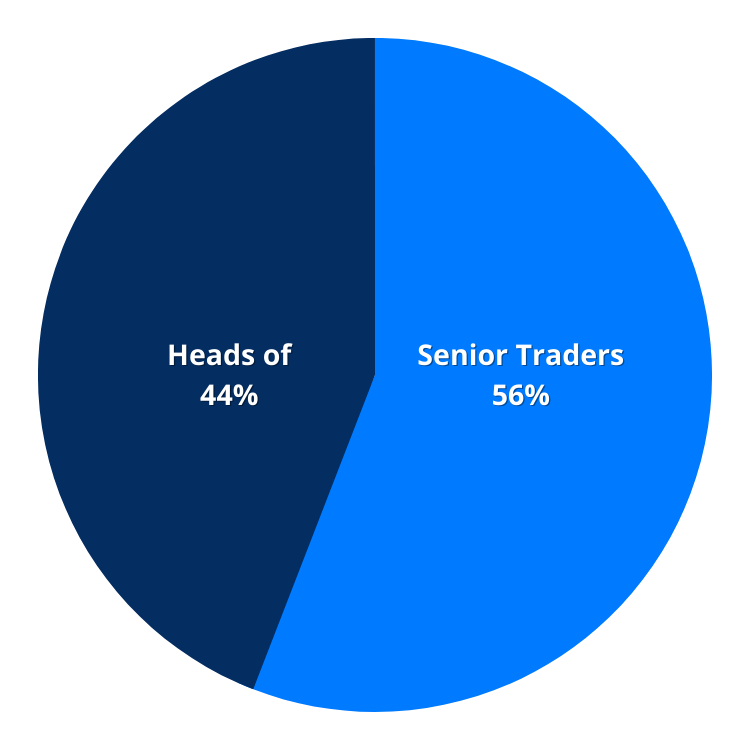

Job Type:

Fund Type:

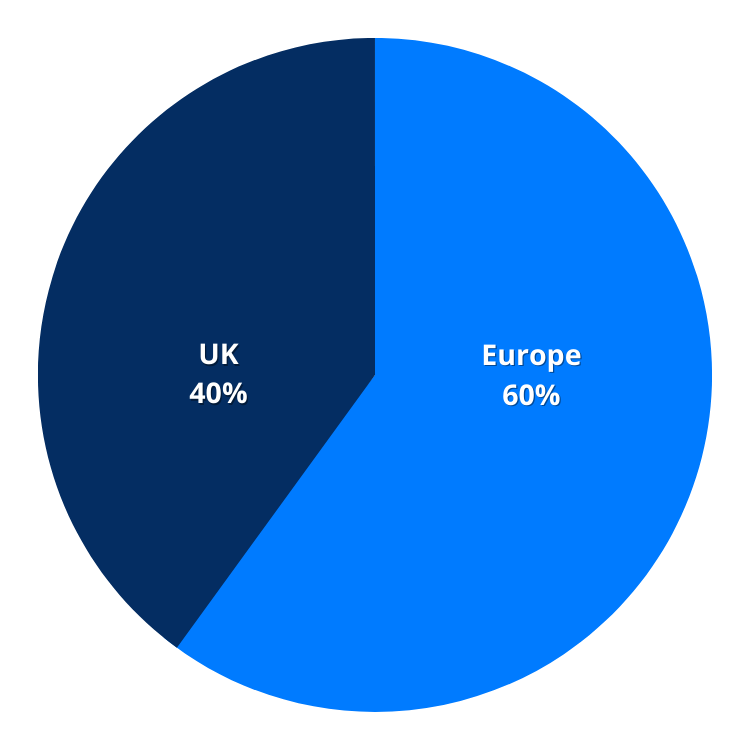

Geo:

Interactive Learning & Networking

Get ideas from all the great minds in the audience through a variety of small working group discussions.

Buy side think tanks

Deep Dive workshops

Interactive panel discussions

Case-studies

An exclusive, invitation-only meeting for 70 Buy Side Heads of Equity Trading

Benchmark your equity trading strategies and data and tech capabilities with those leading the way

Become a Sponsor

Put your best sales people in 1-1 pre-scheduled meetings with Buy side Heads of Equity Trading